Understanding DeFi: Being Your Own Bank

Decentralized Finance removes the middleman from lending, borrowing, and trading. The risks and rewards of the new financial frontier.

S

By sarah-jenkins

Financial Analyst

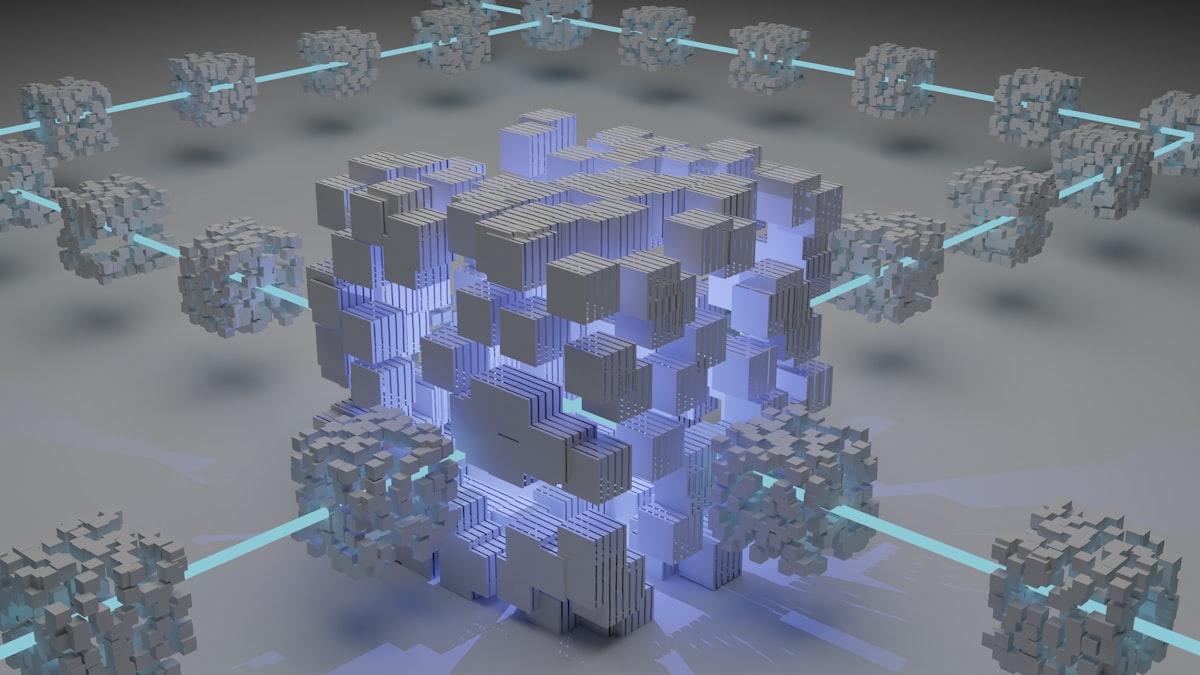

Traditional finance (TradFi) relies on intermediaries: banks, brokerages, and exchanges. They act as trusted custodians of your funds. Decentralized Finance (DeFi) replaces these intermediaries with smart contracts—code that executes automatically on a blockchain (primarily Ethereum).

Core DeFi Primitives

DEX (Decentralized Exchange)

Platforms like Uniswap allow you to trade tokens directly from your wallet without depositing funds onto an exchange.

Lending Protocols

Platforms like Aave allow you to lend your crypto to earn interest, or borrow against your crypto holdings without a credit check.

The Risks

“Not your keys, not your coins” is the mantra, but self-custody comes with responsibility.

- Smart Contract Risk: If the code has a bug, hackers can drain the pool.

- Impermanent Loss: Providing liquidity can lead to losses if asset prices diverge significantly.

- Regulatory Uncertainty: Governments are still figuring out how to regulate code that has no central headquarters.